A flat tax would create pain for most Wisconsinites and a windfall for the state’s wealthiest

An idea endorsed by Tim Michels is a shell game. A new report from the Wisconsin Legislative Fiscal Bureau shows why.

The Recombobulation Area is a six-time Milwaukee Press Club award-winning weekly opinion column and online publication written and published by veteran Milwaukee journalist Dan Shafer. Learn more about it here.

Analysis by Phil Rocco and Sam Harshner of Marquette University

The 2022 midterms could rightly be called “pocketbook” elections. And Wisconsin is no exception.

In his only debate with Gov. Tony Evers, Republican gubernatorial candidate Tim Michels pledged to do “massive tax reform to get more money in people’s pockets” so that the “hard-working taxpaying people of Wisconsin will spend more of that money on goods and services, helping make our economy here even more robust.”

Michels’ favored approach to tax reform––a radical change from Wisconsin’s current income-tax structure––has received little scrutiny to date, in part because he has provided few details about it.

Yet a new analysis reveals that a “flat tax” of the sort Michels has endorsed could significantly increase taxes on all but the wealthiest Wisconsin filers. And even if the plan were revised to avoid these substantial increases, it would require massive cuts that would decimate vital public services provided by the state of Wisconsin.

“Flattening” means higher taxes for most Wisconsinites or an existential crisis for state services.

While Michels has indicated his support for further “flattening” Wisconsin’s income tax structure, he has been notably light on details. During a Baraboo campaign stop in early October, Michels signaled that he was open to replacing Wisconsin’s current tax code with a flat income tax, equating the proposal with a tax cut. “I'm going to sit down with all the smart tax people, we're going to figure out how low we can get the income tax,” Michels said.

This might be the most clarity Michels provides about his tax policy preferences before the election. But it’s still possible to piece together what flat-tax proposals would look like, and what their effects would be.

A new analysis prepared by Wisconsin’s nonpartisan Legislative Fiscal Bureau (LFB) shows why. In order to enact a flat tax without significant spending cuts (a “revenue neutral” plan), the LFB estimates the new flat tax rate would have to be 5.22%.

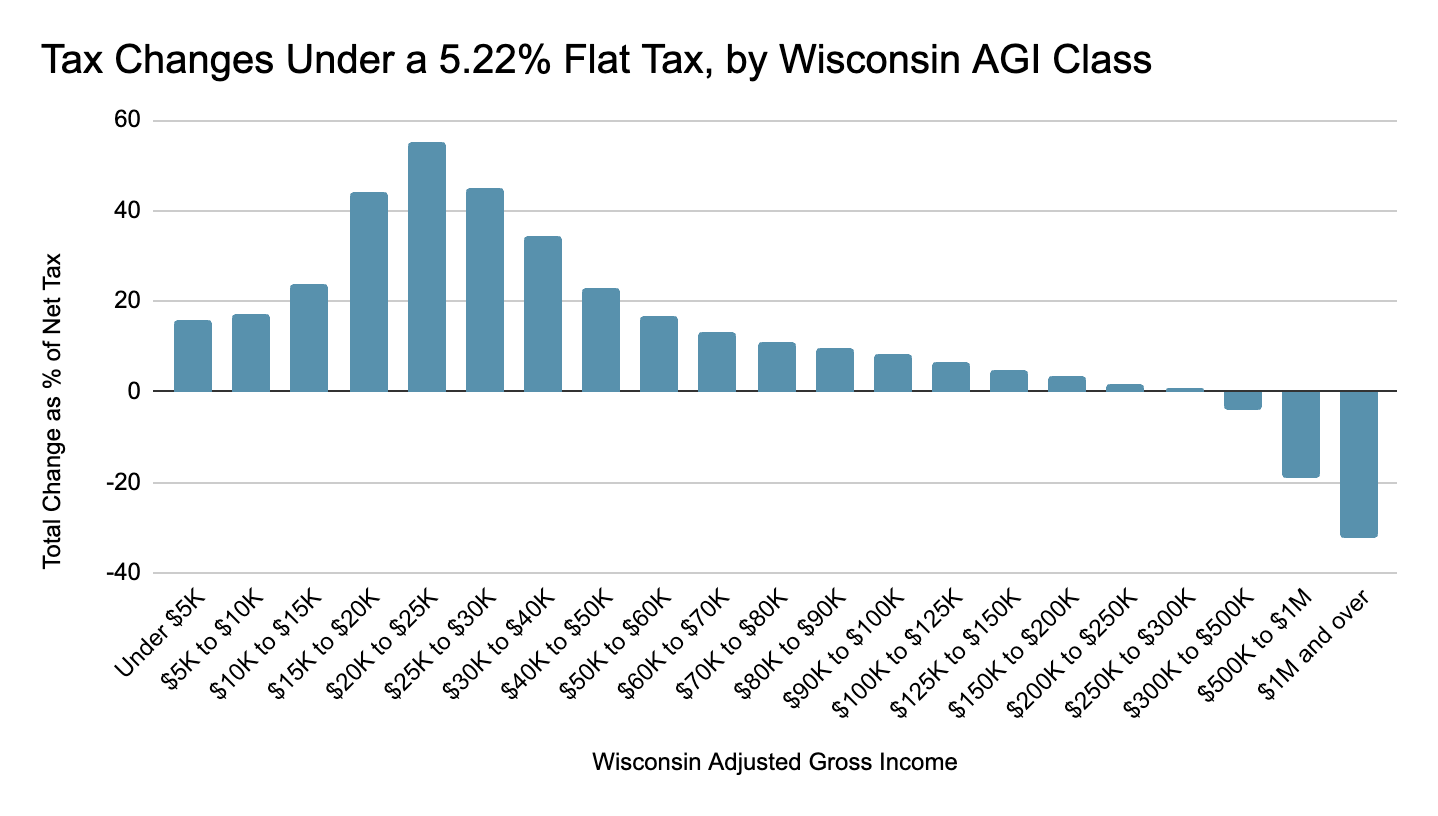

Were the state’s current tax code replaced with a 5.22% flat tax, the LFB projects that some 2.35 million Wisconsin taxpayers (72.5% of all filers) would see their taxes go up by $249 per year, on average. By contrast, only 2% of filers would see their taxes go down (see the dark blue bars in the chart below).

Source: Legislative Fiscal Bureau

While the majority of Wisconsinites would pay more in state income tax under this proposal, those at the top of the income distribution will pay less. As the chart below shows, those who benefit most handsomely from the proposal are filers with annual incomes in excess of $1 million. By contrast, as the LFB reports, “the largest estimated tax increase is incurred by filers with Wisconsin AGI between $20,000 and $25,000 (55.2%).”

Source: Legislative Fiscal Bureau

To be sure, Michels has said that he does not want to raise income taxes on anyone. Yet for a flat tax to do that, its rate would have to be lowered to the one that currently applies to the lowest tax bracket, or 3.54%.

This lower rate, however, would mean that the state’s revenue would fall by roughly $5.6 billion in the law’s first year and $3.86 billion in every subsequent year.

Assuming the state legislature is unwilling to pass significant new regressive sales or property taxes, financing a flat tax would require massive spending cuts. To put this in context, let’s consider what it would mean to cut $3.86 billion from the state budget. Today, $3.86 billion accounts for nearly half of the individual income taxes the state collects each year. As the table below shows, this is also equal to 18% of total general purpose revenues in Fiscal Year 2023.

This amount is also half the size of aid to K-12 schools, and four times greater than the total amount of shared revenue that supports all county and municipal services each year.

Source: Wisconsin Department of Administration

The bottom line: Affording a flat tax means slashing and burning major services Wisconsinites rely on. Financing a flat tax that is not revenue neutral is hardly a matter of wringing savings out of government or eliminating “waste, fraud, and abuse.” It will require strangulating critical services, including public safety, education, and healthcare. Flat taxes also make it more difficult for states to respond to recover lost income during economic downturns — something that should draw concern especially given fairly bleak revenue forecasts in 2023.

Bad tax reforms thrive in darkness.

Taken together, these forecasts might help us understand why Michels has not yet released a detailed tax plan. While bold promises of tax reform tend to attract media attention, the effects of proposed changes — buried as they are in the complexity of the tax code, and the obscurity of the legislative drafting process — are rarely discussed until after legislation has passed. The result is that appealing rhetoric about middle-class tax cuts and “simplifying the code” conceals a significant upward redistribution of wealth.

The George W. Bush administration, for example, strategically designed its 2001 tax cuts to mask this upward redistribution. Most filers received the majority of their tax savings immediately while the majority of benefits applying to the richest 1% of Americans were designed to phase in over time. Yet neither the Treasury Department nor Congress produced distributional analyses of the law before it passed, and Republican leaders preempted consideration of their effects on public programs. The Bush tax cuts thus sailed through Congress, avoiding what could have been a firestorm of public backlash.

Republicans had a more difficult time avoiding public backlash for passing the 2017 Tax Cuts and Jobs Act, whose benefits were directed overwhelmingly towards the richest 20 percent of Americans. The TCJA will likely go down in history as one of the least popular pieces of major legislation ever to make it through Congress, less popular in fact than some major tax increases. Nevertheless, Republicans — perhaps more fearful of retribution from donors than voters — held their noses and passed the legislation.

Michels is likely banking on a similar set of political dynamics unfolding were he to win in November. Yet, however one slices it, flattening Wisconsin’s income tax would create pain for most Wisconsinites. On the one hand, a revenue-neutral flat tax would lead to a higher annual tax burden for most filers. On the other hand, legislation that does not raise taxes on most Wisconsinites would — absent increases in regressive sales or property taxes — likely decimate state programs.

But the point of these tax reforms isn’t simplifying the code or lightening the load of middle-class taxpayers. It’s about further consolidating wealth and power to Wisconsin’s political elite.

The flat tax as institutionalized piracy

While tax policy is most commonly thought of as a means of financing expenditures, it is also an important component of how state governments allocate political power. However it is designed or implemented, the flat-tax idea Michels has endorsed is best thought of as the culmination of decades of Republican lawmaking aimed at destroying institutions that provided pathways to economic stability for working people.

Over the last few decades, Wisconsin Republicans have ceaselessly attacked institutions like public schools, public higher education, and labor unions, even while funneling public resources to corporate interests via economic development policy. A decline in state education funding has foisted costs onto the backs of local homeowners and forced school districts into austerity cuts even as they face unprecedented Covid-related educational challenges and a statewide teacher shortage. Decreasing investment in higher education has placed an unsustainable tuition burden on students and their families and has created an astronomical rise in student debt. The assault on organized labor, refined to an art in the State of Wisconsin, has resulted in decades of wage stagnation while corporate wealth has exploded. Republicans in the legislature have repeatedly turned down billions in federal funding which would allow tens of thousands of Wisconsinites to gain health insurance through Medicaid. For working Wisconsinites, economic burdens continue to grow even as the pathway to middle-class stability becomes more treacherous.

Meanwhile, the Republican regime in Wisconsin has shown no such parsimony in its approach to corporate welfare. The egregious $3 billion gift to Foxconn by the Walker administration is the most blatant example of Republican largesse, but it extends beyond the headlines. A 2015 report showed state-level investment in corporate welfare increasing and trending above the national average, and many of these grants, administered by the Wisconsin Economic Development Corporation (WEDC) were given out without any semblance of oversight or accountability. The party wants drug testing for food stamps recipients, but no “personal responsibility” for corporations looting the state.

A flat tax — no matter what form it takes — only contributes to what might be called a decades-long strategy of institutionalized piracy, in which the power of the state is used to prey on the wages, savings, and political leverage of ordinary citizens on behalf of cronies and economic elites.

The result of this approach to governance is that the cost of the risks associated with daily economic life increasingly falls on the backs of working people, while large corporations receive handouts and tax exemptions.

The enactment of a flat tax would constitute the next stage in this strategy of piracy, and one further step away from the state’s history of commitments to ordinary citizens, including the creation of a progressive system of taxation.

The political fight necessary to return to that commitment will be a long one, but it starts by holding the line against the financial predation of a potential Michels administration.

Philip Rocco is an associate professor of political science at Marquette University.

Sam Harshner is a visiting assistant professor in history and political science at Marquette University.

Subscribe to The Recombobulation newsletter here and follow us on Facebook and Instagramat @therecombobulationarea.

Follow Dan Shafer on Twitter at @DanRShafer.

"a “flat tax” of the sort Michels has endorsed could significantly increase taxes on all but the wealthiest Wisconsin filers. "

Why aren't WI Dems running nonstop ads talking about this? No wonky BS, just that Michels' plan would result in most of us paying more. It's maddening.